2023 Recap - A Pessimism-Defying Rally

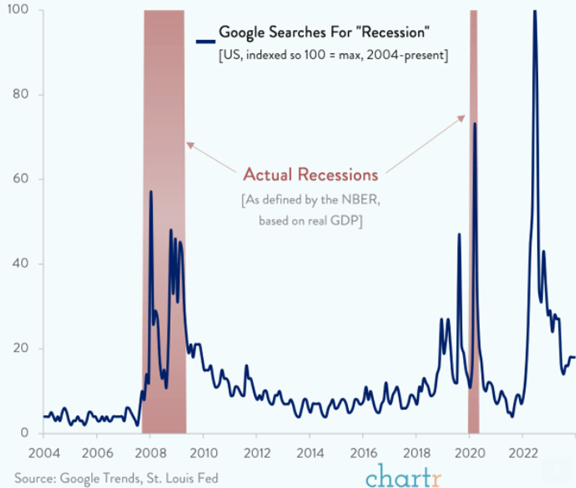

This time last year, pessimism was rampant. Investors had just endured a brutal 2022, inflation was high, and every 2023 forecast referred to a potential, likely, or inevitable recession.

The obsession with recession was understandable. Like in the 1980s, the Federal Reserve’s (the Fed) explicit strategy was to raise interest rates to slow the economy and thereby inflation.

Investors braced for 2022’s pain to persist. For the first time, the average Wall Street strategist forecast a stock market decline. Investor and consumer surveys revealed worse sentiment than during the Great Financial Crisis.

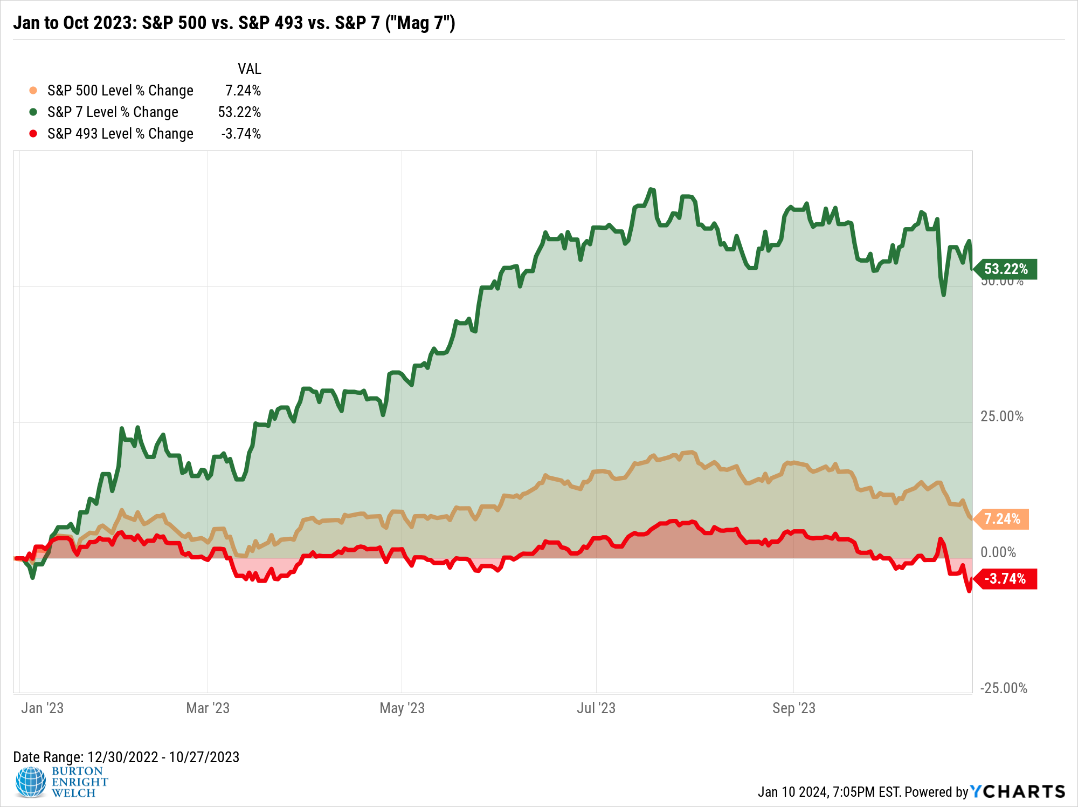

The first ten months of 2023, while better than 2022, were no picnic. Other than the “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla), much of the stock market languished. If you removed the Magnificent 7 from the S&P 500, returns for the remaining 493 stocks were negative.

Small cap stocks and bonds were also negative through October. Meanwhile, there were no shortage of causes for concern – two wars, threats of government default, and the second, third, and fourth largest bank failures in U.S. history.

Cynicism led many to “T-Bill and Chill” – buy cash equivalents earning 5+% and wait for warmer investing waters.

But, as we know, investment returns are anything but linear. November and December flipped the narrative, trends, and investors’ moods. The S&P 500 gained for nine straight weeks, the longest streak since 2004.

Beyond the S&P 500, everything rallied. Small cap stocks soared – they had their third best two-month period in forty years. The bond market[1] had its second best two months since 1982.

[1] Bloomberg U.S. Aggregate Bond Index, data back to 1976

Countless inputs influence stock and bond prices. So, it’s impossible for a market narrative not to oversimplify.

Still, the Fed was the catalyst. In November and December statements, the Fed projected no more rate increases and hinted at lowering rates in 2024.

Markets rejoiced. Historically, stocks and bonds have thrived after the Fed stops raising rates.

For stocks, lower rates mean less opportunity cost – stocks become relatively more attractive as risk-free alternatives are less attractive. Corporations and consumers enjoy better terms on loans, which improves cash flow, increases economic activity, and encourages investment.

Lower expected rates also make existing bonds more valuable. Bonds’ two-month surge erased almost half of the decline over the previous three years. Still, the bond market remains in an unprecedentedly long and steep slump.

Thus far, we’ve called out what made 2023 a notable year. Years from now, 2023’s features will flatten, and its legacy will be the results, which look rather typical – double-digit year-end returns with a double-digit intra-year decline.

As we look ahead to 2024, it’s important to recognize that this is how investing often looks – wonderful in the rear-view, scary on the horizon.

A Note on Predictions

Speaking of which, it’s annual prediction season again. This year forecasters have turned more upbeat. Most expect no recession, modest stock market gains, and the Fed to trim rates.

Lin Wells worked at the Pentagon during the Clinton and George W. Bush administrations. He drafted the following memo in April 2001. At bottom is the takeaway.

Five months later, 9/11 happened. The next decade saw two wars, two giant stock market crashes, a housing bubble, and the worst financial crisis since the Great Depression.

Our default assumption should be that the world is unpredictable and big risks are unforeseeable. Forecasts help us make decisions and think about the future. But even consensus predictions rarely work out.

Take 2024 market forecasts with a giant grain of salt.

Looking Ahead to 2024

The November/December 2023 rally brought stocks to near where they started 2022. It’s been a trying two-year journey. The rally was a reward for the volatility endured.

Suffice it to say, 2024 promises to be … an interesting year. We look forward to overcoming whatever challenges come. Though it won’t be easy (it never is), we expect 2024 will be another valuable chapter in the long-term story of investing.

Happy 2024!