Apple, Snapchat, and the Long-Term Case for Stocks

There is no shortage of charts that illustrate the rough first half to 2022.

The one below shows the companies that make up the NASDAQ.

Barely a corner of the market has gone unscathed. On five days in June, 90% of the stocks in the S&P 500 declined. This had happened zero days since 1928.

The box sizes above correspond with the companies’ relative market capitalization (value). All of the largest ones are deep red – Microsoft, Apple, Google, Facebook, Amazon, and Tesla have lost a combined $3.5 trillion in value this year.

Energy stocks are the big green exception. Yet, lest you envy energy investors, energy stocks have been consistently among the worst performers over the last dozen years.

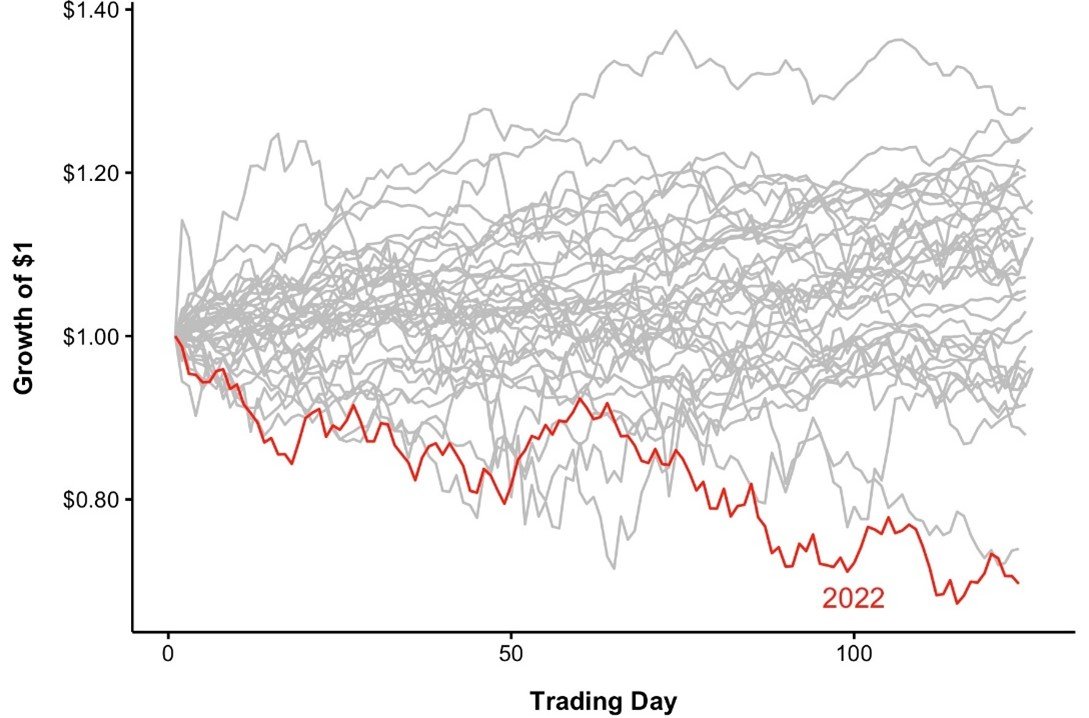

The next chart shows that this was the worst January-thru-June in over five decades, worse than any start to the year during the Dot-Com bubble or the Great Financial Crisis.

Speaking of Dot-Com, the tech-heavy Nasdaq index is down further this year than during any January-June ever, including during the early 2000s.

Stocks Are Businesses

In previous posts, we’ve presented the long-term story of the stock market post-downturn. History repeatedly shows the rewards of perseverance. After all, U.S. stocks are up 10% per year since 1928.

Yet, we realize data may feel a bit dull in the face of today’s dangers. Yes, investors should stay the course, but what about high inflation, supply chains, a land war in Europe, the Fed, etc.?

Discussions about investing often overlook the obvious fact that stocks are businesses. Although we invest in mutual funds and ETFs (diversified baskets of stocks), individual stocks can help illustrate the long-term case for investing and why, in part, the market is down.

Apple

Let’s look at some of the mathematical magic behind the world’s most valuable business – Apple.

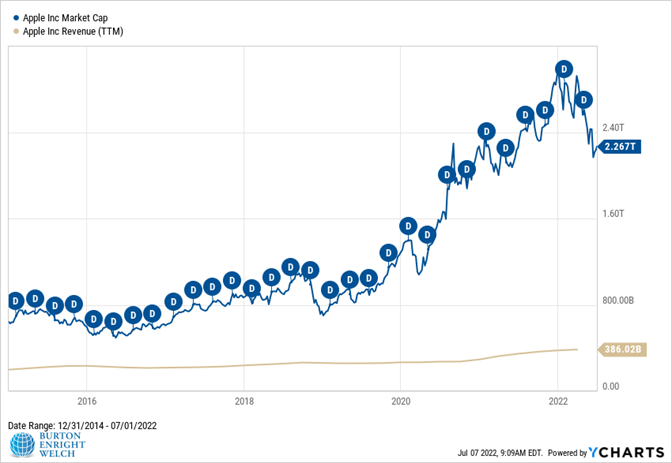

At the end of 2014, Apple had total sales of $182 billion and a net profit of $40 billion. Since then, those numbers have more than doubled. In 2021, Apple’s sales were $386 billion and profits were $95 billion.

During that time, Apple paid more than $100 billion in dividends (“D” in chart below). Apple’s value also quadrupled.

Apple, like the entire economy, is focused on building a better mousetrap. When you see a child everyday, it’s hard to see that they are growing taller, smarter, and stronger.

Similarly, it’s hard to notice the leaps in technology with each new iPhone model. Yet, comparing 2014’s iPhone 6 with 2022’s iPhone 13 is like comparing a sixth grader to a college kid.

We’re often asked how our portfolios will handle a macroeconomic or geopolitical issue. Much of the answer resides in our confidence that companies will work through and overcome today’s issues.

Yes, inflation, supply chains, wars, etc., may harm Apple and other businesses. But macro conditions do not drive the day-to-day conversation at these companies. Their focus is creating value by innovating, investing, and growing.

It sounds obvious but bears reminding – the stock market grows over time because companies make more money. In 1982, the entire U.S. stock market was worth $1.2 trillion. Today, Apple is twice that.

Snapchat

Of course, investing is not as simple as – buy Apple. Investors should always evaluate a stock through the lens of price.

Snapchat is a popular social networking service. Since its 2007 IPO, its revenue is up nearly 1000% to $4.4 billion.

Snapchat’s stock peaked in September 2021. Since then, it is down 84%, which leaves it 42% below its IPO. Why?

Snapchat did an incredible job of growing its business and userbase. However, investor expectations outpaced this growth and bid Snapchat’s stock price up sky high.

All over the market in recent years, and particularly in tech stocks, investors have prized growth. They have not worried about when and how much of that growth will turn into profits.

On average, companies pay out about half of their profits in dividends. Ultimately, investors’ expectation of dividends powers stock prices. With interest rates low, investors have been okay if those dividends do not arrive until far into the future.

As we’ve discussed, sentiment has shifted with the U.S. Federal Reserve Bank (Fed) raising rates. Instead of just growth, investors want companies with foreseeable profits and dividends.

Snapchat has yet to turn a profit or deliver a dividend. It may continue to be a great company. Yet its peak price depended on investors not demanding profitability in the near future.

Snapchat is a good example of how investing is not as simple as buying good businesses. Stock prices need to connect to eventually delivering shareholders a return on their investment. With higher interest rates, investors want to see a shorter, clearer path to profits and dividends.

Glass Half Full

We’d be remiss if we didn’t end with some glass-half-full data.

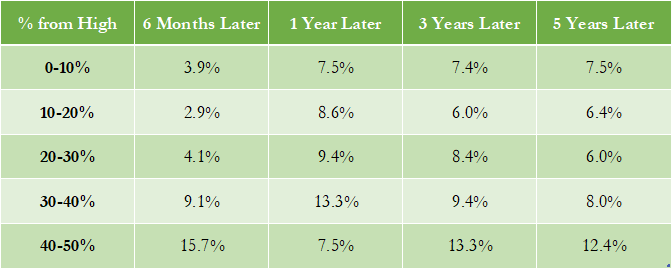

During dismal markets, people turn pessimistic and imagine that the worst is still ahead. Historically, this is the time to be optimistic. The next charts shows average post-decline S&P 500 returns.

Every downturn happens for different reasons, but they all share the same basic math. Future returns increase after declines – the steeper the decline, the higher the returns.

Of course, investing cash in the teeth of a downturn is easier said than done. Periods like this highlight why 401(k)s are great. You methodically and unthinkingly invest with every paycheck. When prices decline, the number of shares you purchase increases. See the number of shares your March 2020 contributions purchased relative to a few months earlier.

If you have cash that you can invest for the long-term, it may be a great time to buy. We can help you automate your investing just like a 401(k) if doing so in small chunks is more comfortable.

When the economic news is gloomy and pessimism abounds, it’s a particularly good time to reach out to us to discuss concerns. We have been through many periods like this before. We look forward to helping you through this one.