The Newly Exciting World of Cash Alternatives

We’ve written about 2022’s dramatic trend reversal for stocks and bonds. Last year was no less dramatic for cash.

At the beginning of 2022, 1-Month U.S. Treasuries yielded 0.06%, what they averaged from 2010 through 2015. Today, they yield 4.63%, a 77x increase.

Over the previous decade, it didn’t matter much whether you left cash at the bank or put it in a money market fund, CD, Treasury, or under your mattress.

Today, though still modest, savings account rates are at their highest level since the Great Recession. Meanwhile, yields on cash alternatives have skyrocketed.

Why the discrepancy between savings account rates and cash alternatives?

Banks’ main source of profits is the difference between what they pay savers and what they earn by lending or by investing (often in cash alternatives). When rates rise, savers are slow to acclimatize and pressure banks to lift rates.

So, to take advantage of higher rates, you must put in a bit of work. And with rates near 5%, a bit of work can go a long way.

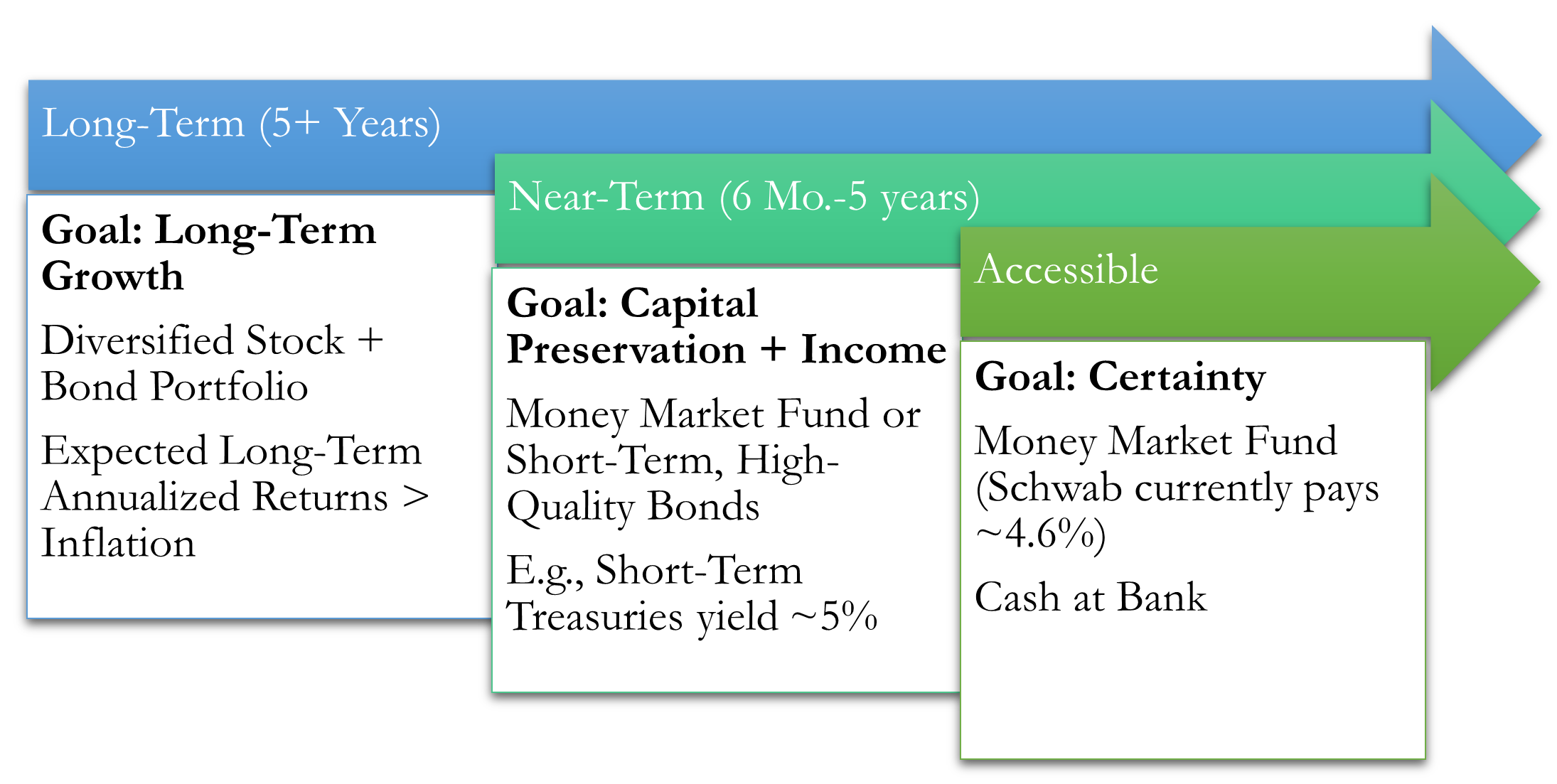

Here is how we evaluate the options when clients have extra cash.

Operating Cash

Cash needed for monthly expenses should stay accessible at the bank. The additional yield is not worth the hassle of sending it back-and-forth to an investment account. The banks will make some money, just don’t let it be too much.

Earmarked – Definite

For a large upcoming expense, e.g., car, remodel, taxes, real estate, our recommendation depends on the time horizon.

If the horizon is definite, e.g., a 2024 car purchase, then we may buy a U.S. Treasury bond to match the timeline. We’ll lock in the interest rate and protect against rates falling in the interim.

We prefer Treasuries to bank CDs because Treasuries pay a bit more, there are no penalties to sell before maturity, and they are exempt from state income taxes.

Earmarked – Indefinite

For imminent (e.g., < 1 year) needs, we’ll buy a money market fund. Money market funds invest in very short-term, high-quality bonds, CDs, and commercial paper. Like cash, they typically do not fluctuate in value.

For needs further out (e.g., > 1 year), we may use a short-term bond fund. Bond funds own hundreds of bonds that mature on different dates. They reinvest income from maturing bonds, so you remain fully invested. Unlike cash or money market funds, the value fluctuates daily.

Comfort vs. Opportunity Cost

Many love cash for the sleep-at-night factor. Cash offers certainty – a dollar today will be a dollar tomorrow. Cash also has practical merits – it can improve perseverance with portfolios through volatility.

However, without a foreseeable need for cash, investors should weigh the opportunity cost of a larger cash security blanket.

Investing lacks cash’s certainty – a dollar today may be worth 99 cents tomorrow and a $1.02 the next day. But with a long time horizon and patience, the probabilities tilt heavily in favor of investing.

Moreover, the case for investing is especially strong today. Investors buy stocks and bonds at a discount relative to 2022 prices.

Historically, these “buy low” opportunities have produced strong long-term results. Last year was the worst year for a 60% stock and 40% bond portfolio since 1950. Previously, 60/40 portfolios have shown resilience after tough years.

Conclusion

Taken too literally, a “cash is king” mindset foregoes options that haven’t been as attractive in many years.

Pursuing them requires a bit of work. But in today’s environment, the payoff may be sizable.

We’re here to help. Please reach out if you would like to discuss more.