What Recessions Don’t Mean for Markets

We’ve spoken to many clients in recent weeks. The top question is – when will this end? And the top comment is – I don’t think this will be over anytime soon.

The question is about the stock market, and the comment is about the economy and the prospect of a recession.

Talk of a recession is everywhere. A recession is an economic decline measured by Gross Domestic Product (GDP). Economists review data to declare a recession, so we do not know when one started until months later.

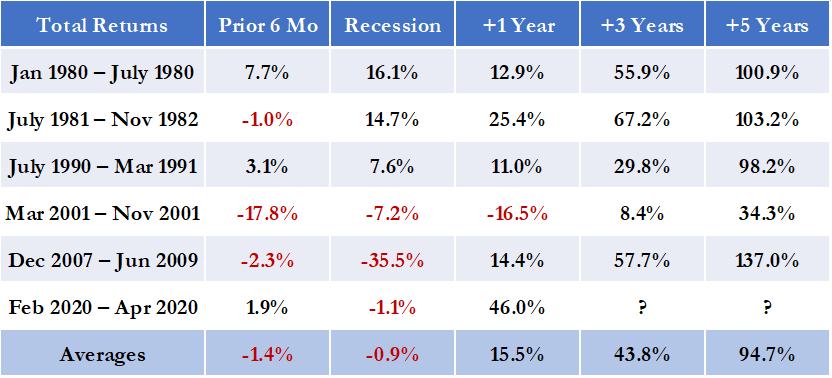

Here are some facts about recessions since 1980:

There have been six recessions, or one every seven years.

The longest ran from December 2007 to June 2009. GDP declined 5%.

The shortest was from February to April 2020. GDP dropped 19%.

The average recession lasted ten months and GDP fell 5% (excluding Covid, the average GDP decline was 2%).

GDP declined in 58 months or about 12% of all months.

GDP per capita doubled from 1980 to 2021.

Taken in sum, recessions are normal and more of a distraction than a feature.

Still, many conflate an impending recession with further pain in the stock market – a recession is coming, the market is going to drop more!

There is no reliable correlation between a recession and stock market performance. Three of the six recessions since 1980 featured positive stock market returns.

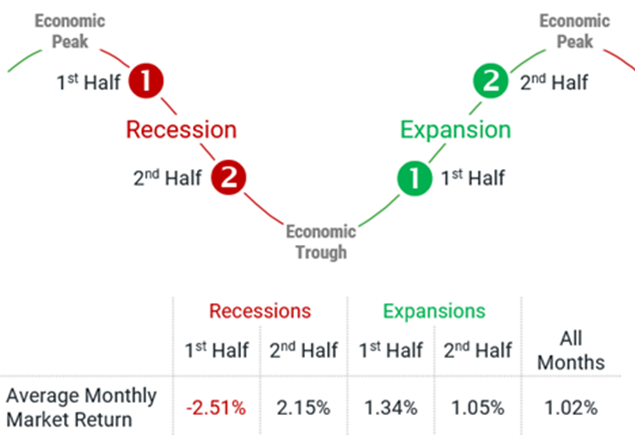

Why? The stock market is forward-looking. It tends to trough well before the recession ends. It also foresees the recession’s end – the strongest returns happen during the second half of recessions.

The charts suggest that investors should attempt to sell before a recession and then buy when the recession is at its most painful.

Of course, as evidenced by the Federal Reserve (Fed) in recent years, no one – economists included – can consistently forecast the economy. The market is terrible at predicting recessions (as seen below courtesy of Ben Carlson). There is no reliable way to predict when a recession will begin, how deep it will be, nor when it will end.

Looking at recessions in sum helps us see that a recession on the horizon does not necessarily mean a market decline.

What About This Recession?

Recessions happen for many and varied reasons. Here, we have a manmade economic decline in response to a manmade predicament.

The pandemic triggered the greatest economic experiment of our lifetimes – can we shut down the economy and not cause a second Great Depression?

Thankfully, the answer was, yes. Within a year-and-a-half, the government delivered $4 trillion into the economy via direct payments to businesses, individuals, and state and local governments.

At the same time, the Fed slashed interest rates to zero and directly purchased trillions in bonds to ensure that the economy remained liquid. Corporations enjoyed rock bottom borrowing rates, which lead to record profit margins and stock buybacks.

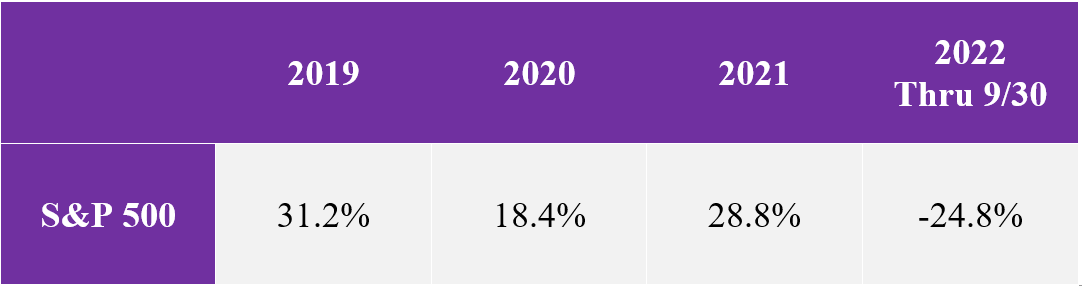

From the March 2020 low, the S&P 500 doubled in less than one year. Over 95% of the S&P 500 companies had a positive return. In 2021, there were a record 1,000+ Initial Public Offerings (IPOs).

Yet, it is pretty clear in retrospect, that all that money flowing in the economy had a negative consequence – high inflation for the first time in 40 years.

The Fed is rapidly raising interest rates to slow the economy and break the back of inflation. That the Fed is open about potentially causing a recession is confounding considering how much pain and anguish recessions cause.

The Fed is following its playbook from forty years ago when it snuffed out the high inflation of the 1970s and early 1980s. The cure wasn’t pretty – the Fed raised rates to over 20%, unemployment soared, and the S&P 500 was down 27% at its 1982 low.

Yet, the Fed’s actions worked. With inflation succumbed, the greatest ever bull market started and lasted until 2000.

The S&P 500 grew 24% per year from 2019-2021. In hindsight, some of that return was the result of government overstimulation. Perhaps, this year’s misery is the price investors must pay for those boom years.

While it’s been forty years, we have seen this movie before. No one knows whether we are in the early, middle, or late innings of this inflation story. What we do know is that the Fed is enacting a cure that has been effective. Like last time, investors must endure pain while we wait for the cure to work.