The Ins and Outs of Roth Conversions - a Powerful Planning Tool

By Alex Soderberg

For most Americans, fall means football season. For financial planners, fall means Roth conversion season.

There may be no financial planning strategy that is more impactful and underused than Roth conversions.

The ins and outs of Roth conversions can be tricky. But at its core, the idea is simple – pay taxes at lower (or known) tax brackets today and avoid taxes at higher brackets in the future.

Tax Terms

A Roth conversion shifts funds from a pre-tax account to an after-tax account. Let’s set the stage with some basic tax lingo before we explain why this can make sense.

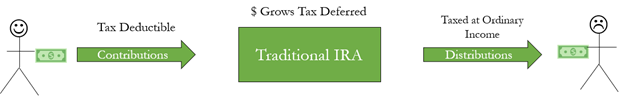

Traditional IRAs and 401(k)s are the most common examples of pre-tax or tax-deferred accounts. Contributions to these accounts are generally made with pre-tax dollars, and investment earnings are not taxed while the funds remain inside these accounts.

However, these accounts are tax-deferred, not tax-free. Withdrawals from the accounts are taxed at ordinary income tax rates. And once you reach age 73 (or 75 if born after 1960), you must take an annual required minimum distribution (RMD), which is the government’s way of forcing taxation.

The inverse of the tax-deferred account is a tax-free account, e.g., Roth IRA or Roth 401k. These accounts were named after Senator William Roth, who helped create these accounts in the late 1990s. Contributions to Roth accounts are after-tax, i.e., the dollars have already been taxed. However, once in the account, income, growth, and distributions are tax-free.

What Is a Roth Conversion?

A Roth Conversion transfers dollars from your tax-deferred account to a tax-free account. The amount transferred from the tax-deferred account counts as taxable income in the year transferred.

You do not have to convert an entire tax-deferred account balance in one year. Rather, you can do a partial Roth conversion and convert any dollar amount.

What Is the Benefit?

Plain and simple, Roth conversions are about tax arbitrage – locking in taxable income at a lower tax rate today than we, or our heirs, expect to pay in the future.

That arbitrage also suggests a diversification benefit. Most people’s retirement assets are heavily tax-deferred (most 401(k) saving is pre-tax). We don’t know what tax rates will be in the future. Paying taxes today eliminates the uncertainty and protects against a potential spike in future tax rates.

Here is a common example of the benefits.

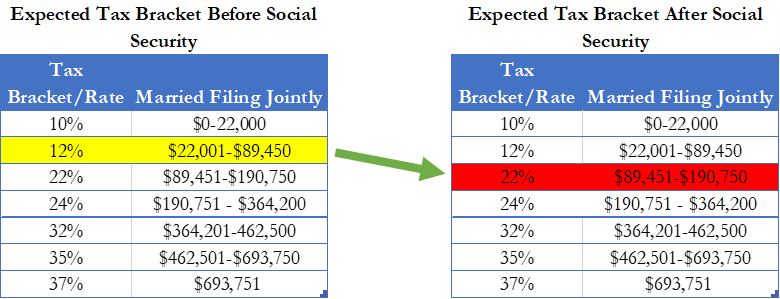

Tim and Rebecca saved diligently during their working years. They are ready to retire, and their 401(k) retirement accounts are entirely pre-tax. They also have cash savings, which they can live off of for a few years before they start social security.

In the years before Social Security starts, they will have minimal taxable income, which opens the door for Roth Conversions. They can convert dollars today in the 12% tax bracket and avoid future taxation in the 22% or higher bracket.

Why Recognize Additional Income Now?

Beyond the tax arbitrage described above, there are other reasons to consider a Roth Conversion.

Reduce RMDs

The government does not allow you to keep your funds growing tax-deferred forever. Once you turn 73 (or 75 if born after 1960), tax-deferred accounts are subject to an RMD. Funds converted to Roth IRAs are not subject to RMDs.

Tax Cut and Jobs Act Expiration in 2026

Absent law changes, income tax rates will increase in 2026. Most people’s marginal tax rate will increase a few percentage points, even if income stays the same.

Retirement Spending Flexibility

If a retiree only has pre-tax savings, large one-time expenses could spike taxable income into higher tax brackets. Having a Roth account to draw from allows flexibility to control your tax bracket.

For example, if you are in the 33% tax bracket, funding a $100,000 home remodel via a Traditional IRA would require $150,000 in gross withdrawals, which would all be counted as taxable income and potentially invade higher tax brackets. Taking tax-free withdrawals from a Roth IRA would lower/eliminate exposure to higher brackets.

One Spouse is Much Younger or Healthier

Married filing jointly tax brackets have lower tax rates at the same income compared to a single filer. When one spouse passes, the remaining spouse will see their taxes shift to single-filer brackets. Paying taxes now at married filing jointly rates could prevent potentially higher tax rates on the surviving spouse.

You Want to Leave a Tax-Efficient Estate

If you leave pre-tax accounts to heirs, they must eventually take taxable distributions, potentially during their prime earning years. The heirs will have ten years to distribute all funds from inherited IRAs.

For example, an heir of a $2 million tax-deferred IRA would average at least $200,000 in annual distributions, which would all be taxable as ordinary income.

The same 10-year distribution limit is true for inherited Roth IRAs. However, since the taxes were already paid on money within a Roth IRA, the heirs will not owe taxes on distributions.

Also, taxes paid on a Roth Conversion reduce the nominal value of your estate. This helps for those who may be subject to estate taxes.

Hedging Against Future Tax Rate Changes

No one knows what future tax rates will look like. Roth conversions eliminate that uncertainty and reduce the risk that future tax rates are much higher.

When Should I Not Convert?

Here are considerations that may argue against a Roth conversion:

You Have to Pay Taxes Today

For larger conversions, you may see a substantial increase in your tax bill. There needs to be enough cash or after-tax investments to pay the tax liability.

There Is a 5-Year Holding Period on Conversions

There are two 5-year rules that impact Roth conversions. The first requires that a Roth IRA must be open for 5 years before withdrawing earnings tax-free. The clock starts when the first contribution is made to any Roth IRA. The second 5-year rule applies to distributions of converted funds. If you take a distribution within five tax years of any conversion and are under the age of 59 ½, you may be subject to a 10% penalty on earnings.

You Are in a High Tax Bracket

Accelerating income through Roth Conversions while in a high tax bracket makes it less likely that tax arbitrage will work in your favor, i.e., your future tax rate may be lower rather than higher.

You Expect Income to Decrease

If you expect your tax rate to fall in the future, it may be better to defer Roth conversions until then.

You Receive State Healthcare Marketplace Subsidies

A Roth Conversion likely increases the income used to calculate premium subsidies for healthcare exchange plans. For example, a plan on Covered California may have a higher premium if you recognize more income through a conversion.

You Expect to Move to a State With Lower or No Income Tax

Many of our clients in California are accustomed to some of the highest state tax rates in the nation. If you expect to move to a state with no or low state income tax, your future tax rate is likely expected to be lower and a Roth Conversion may not be advisable.

How Do You Invest a Roth IRA?

Ok – you’ve done the Roth conversion, and you now have funds in a Roth IRA. Now what?

If there is any account that you want the highest expected return, it’s a Roth IRA. You keep one hundred cents of every dollar of growth. Whereas, in a pre-tax IRA or a taxable account, taxes eat into some of your growth.

Moreover, because of the five-year rule and the ability to compound tax-free growth, Roth IRA investors should have long-time horizon.

So, Roth IRAs often should be all stock.

Ending Thoughts

Taxes can be a boring topic for some and cause anxiety for others. Yet, well-timed Roth Conversions throughout a financial plan can dramatically limit your lifetime tax bill and improve your portfolio’s after-tax results.

If you have a question about Roth Conversions, please contact your Advisor.